Certified Business Valuation Services

Years of Valuation Experience

Certified Accredited Business Appraiser

Transparent Pricing

Expedited Turnaround Time Available

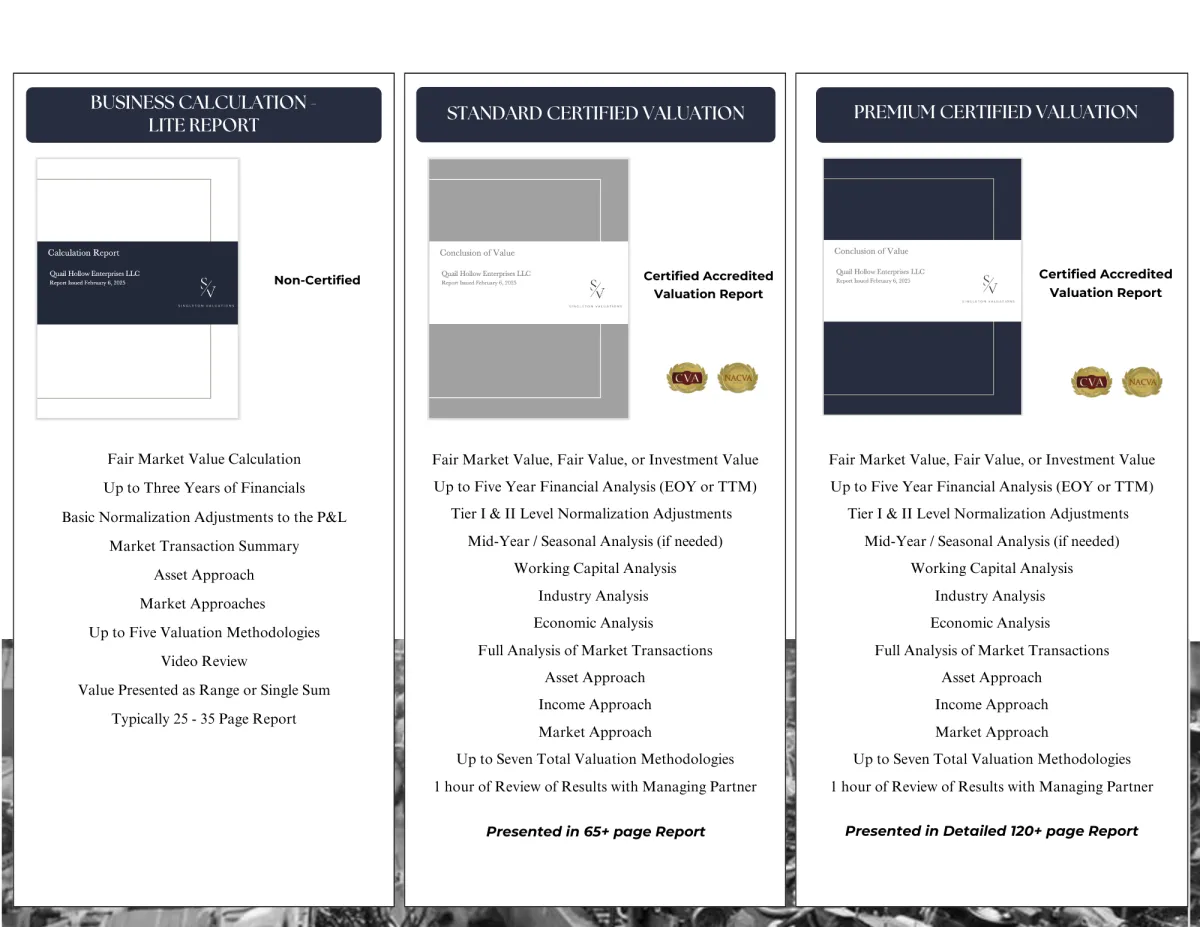

Business Calculation - Lite Report

Our Business Calculation - Lite reports are tailored as cost-effective solutions to help with internal planning. The end product is a 25+ page non-certified report with up to five methodologies that incorporates basic normalization adjustments on the business Income Statement.

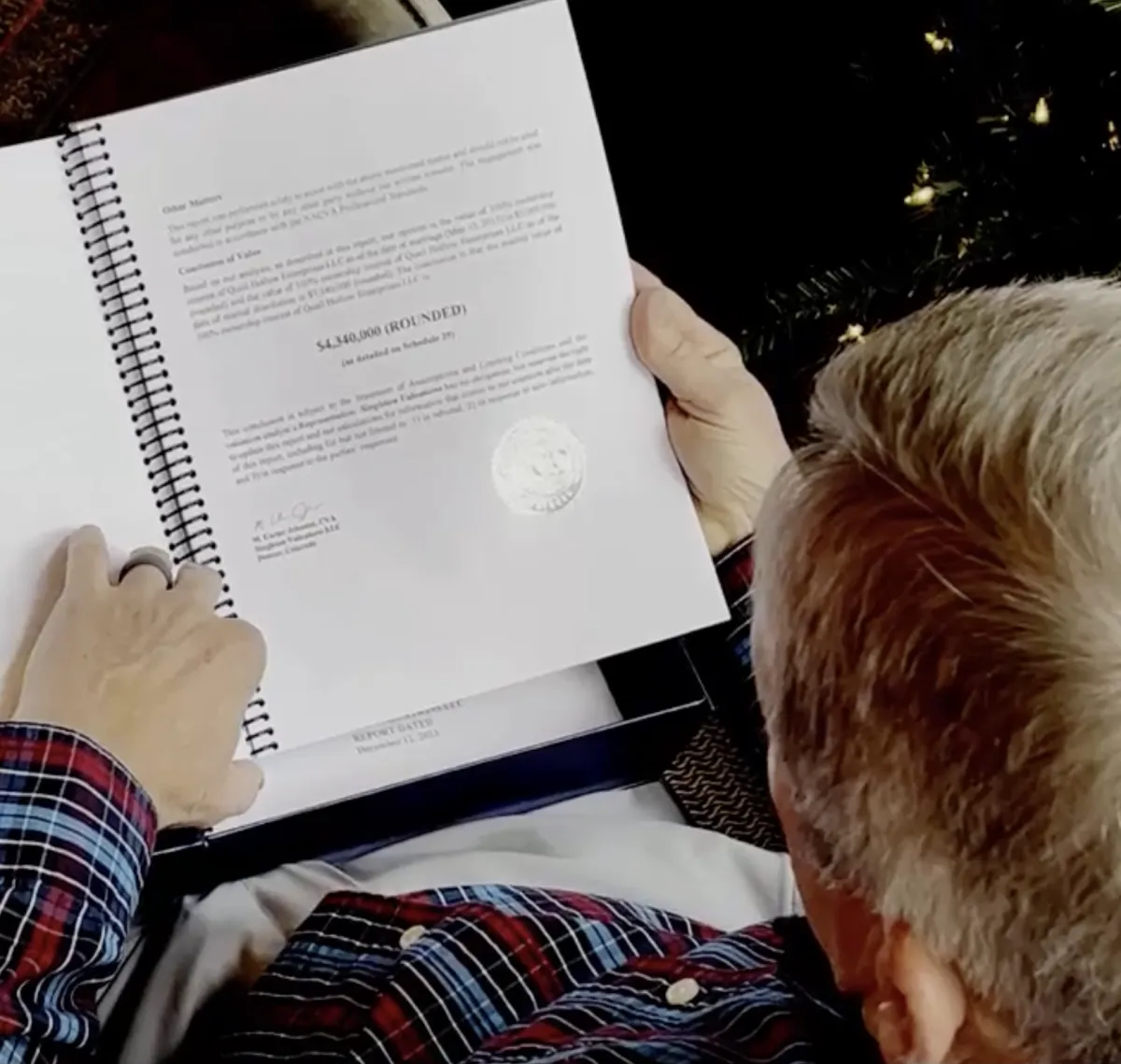

Standard Certified Valuation

Our Standard Certified Valuations, follow all procedures outlined by NACVA to issue an accredited Business Valuation. The end product is a 65+ page certified report, with up to seven methodologies, a full analysis of normalization adjustments, full reconciliation of working capital and retained assets. This report gives clients “peace of mind” with a thorough and complete analysis that is well documented in the end report.

Premium Certified Valuation

Our Premium Certified Valuations are our most robust accredited Business Valuation package. The end product is a 120+ page certified report, presented in a detailed format. This report is ideal for engagements that require the utmost sophisticated documentation of detail of the underlying analysis to underwrite the value of the business.

Affordable, Customized & Certified

Our Valuation reports are individualized to each business that we value. Our analysis captures the specifics of the business to make sure all is accounted for, leaving you with the most precise valuation.

Valuations Specific For Your Needs

We are routinely retained to perform valuations for transactions, divorces, litigation, partnership buy-ins (and buy-outs), business planning, SBA loans, estate and gift tax, fairness of opinion and many other reasons.

What all will I need to provide to complete the valuation?

This is dependent on the purpose of the valuation. Our professional standards require certain items to be reviewed based on the varying types of engagements. For smaller engagements where you are simply need a valuation for benchmarking a company related to buy or sell activity, we can work on as little as a QuickBooks file. For larger engagements or those involving divorce or litigation, we have a more extensive information request.

If this is a concern, please bring it up on our introduction call and we'll be happen to give you more details on what is needed for your specific circumstance.

Aren't businesses just worth a multiple of earnings?

A question we get often is "Aren't businesses just worth some multiple of earnings?" To a degree, Yes! However, before you jump to conclusion ask yourself the following:

1) Are you using cash or accrual based accounting to define those earnings?

2) Are you using a pre-tax or after-tax earnings stream?

3) Are you using a trailing twelve months earnings stream? How about an end of year? Maybe a weighted three-year? Or possibly a weighted five-year? Or should you be using an accelerated weighting?

4) Are you using net cash flow to equity? Net Cash flow to Invested Capital? EBITDA? EBIT? Owners Earnings? Seller Discretionary Earnings? Net Income?

5) Have you made seasonal adjustments?

6) Has inventory costs been adjusted to reflect normal valuation procedures for the specific industry?

7) Have you taken into account all personal and discretionary expenses that are being ran through the business?

8) Have you leased or capitalized equipment over the years?

9) Is the business paying fair market rents? Is the owner compensation over or understated?

10) Have non-recurring occurrences been normalized in the earnings stream?

These are just a few questions to get you started. In essence, all businesses can be valued based on a multiple of earnings, but knowing what and which "earnings" to use are a must if you want an accurate valuation.

What's the process like and how can I get started?

Step 1: Submit your information in the form on this page. This will take you to a scheduling page where you can book a no obligation, one-on-one with our Managing Director (if the times available don't suit your schedule someone from our office will reach out directly to accommodate what's best for you). On this call we will learn more about what you need regarding the business valuation and if it is something we can complete for you.

Step 2: After our conversation, if we're able to help and if you would like to proceed, we draft our industry standard engagement letter.

Step 3: We'll put together a document request helping you organize the necessary information to complete the valuation.

Step 4: We'll do the valuation and collect follow up information from you and management interviews as needed.

Step 5: We issue the valuation report, walking you through each component.

Let's discuss your Business Valuation needs...

**We will never share your information and all inquires are completely confidential**

Singleton Valuations